|

|

|

|

|

|

|

|

|

|||

|

|

|

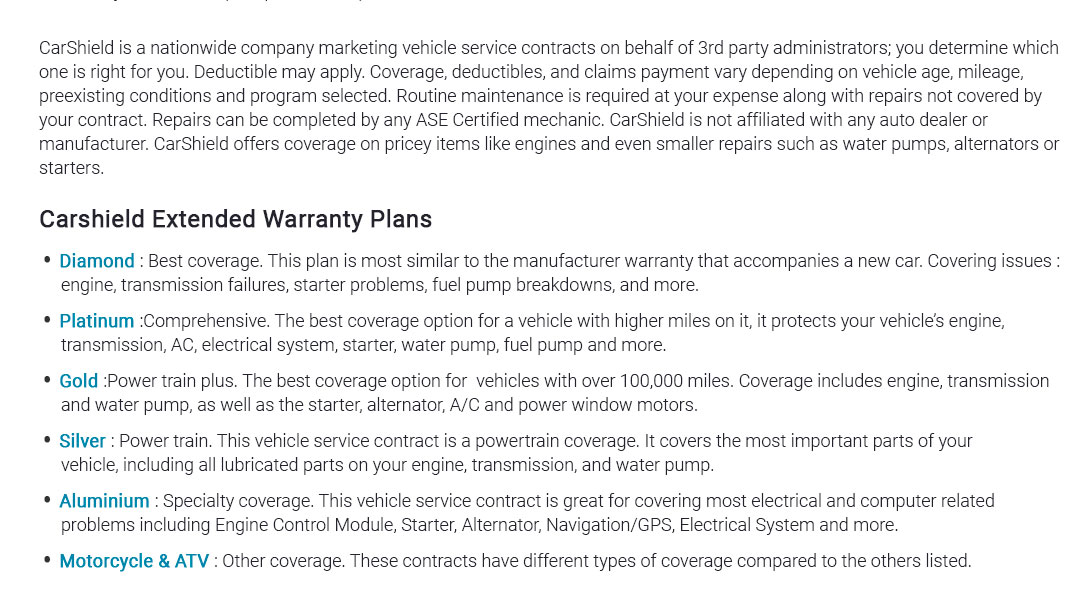

|||||||

|

|||||||

|

|||||||

|

|||||||

|

|||||||

|

|||||||

|

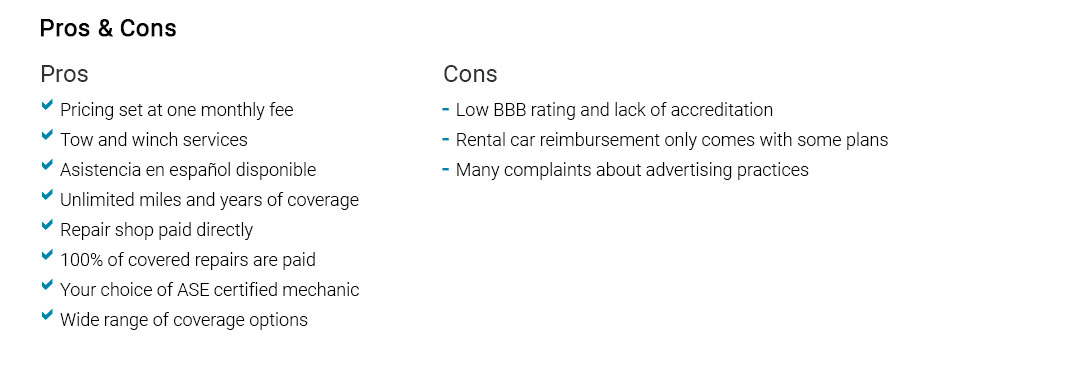

||||||

|

||||||

|

||||||

|

||||||

|

|

|

|

|

|

|

|

auto repair insurance policy choices across the marketCompare how policies handle parts, labor, and claims speed. Some mirror mechanical breakdown insurance, others function like service contracts tied to dealers. The differences shape downtime and out-of-pocket costs. Coverage types at a glance

What to compare

At a Fresno shop, a cracked radiator made me pause - was it wear and tear? The adjuster called it sudden failure; approval in 18 minutes stopped the tow-and-wait spiral. Cost and valueMBI often runs $25 - $70 per month on newer cars; service contracts skew higher upfront. High-mileage commuters and rideshare drivers gain from faster claim handling; DIY owners may choose a higher deductible for broader shop freedom. Quick decision guide

Prioritize clarity and efficiency - clean terms and fast approvals save the most. https://jjinsurance.com/what-kind-of-insurance-do-i-need-for-an-auto-repair-shop/

Every car repair shop must have insurance coverage. Your company's day-to-day operations including dealing with hazardous equipment and on costly automobiles. https://www.thegeneral.com/blog/car-repair-insurance/

Until your warranty expires, any repairs you need on your car should be covered. However, once your warranty is over, you're on the hook for any ... https://www.joinroot.com/car-insurance/car-repair-insurance/

Yes, car insurance can cover repairs, but only if they are for damages resulting from a covered accident. You'll also need to have the right level of coverage.

|